Detailing your operating expenses can provide you with a wealth of information about your business, such as utility costs, wage details, and advertising and marketing costs. Imagine trying to create a budget or financial projections without knowing what your operating expenses are. What do operating expenses tell you about your business?

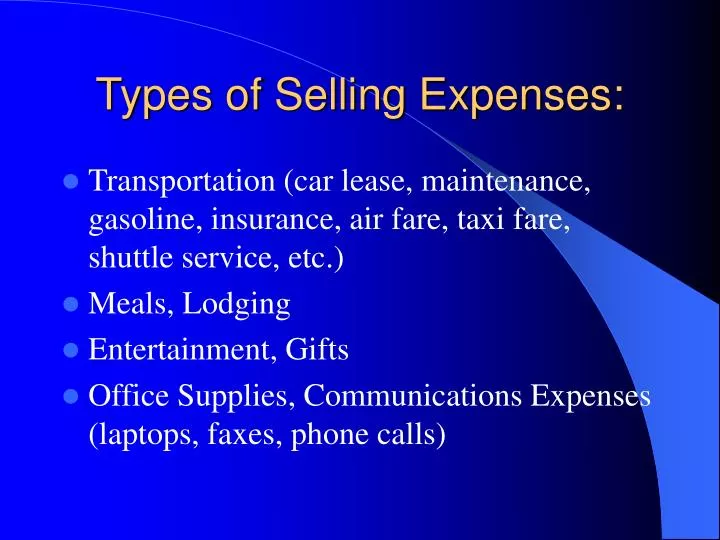

Here's an example of what an income statement might look like: INCOME STATEMENT This total gives you and any potential investors or financial institutions a good look at the financial health of your business, as well as detailed information on how your money is being spent. Net income before taxes, or pretax income, is then calculated by subtracting operating expenses from revenue. However, on the income statement, operating expenses play a more prominent role, with total revenue and total expenses detailed. While operating expenses are typically reflected on your business income statement, they also play a role in both your profit and loss statement as well as your cash flow statement, since each statement is designed to reflect expenses in order to arrive at current profit or loss or current cash flow levels. Operating expenses on an income statement Operating expenses are typically divided into several categories such as payroll-related expenses, administrative or overhead expenses, and sales and marketing expenses. All of these things are considered operating expenses. Jessica also needs to pay her landlord rent in the amount of $1,000 each month. The bakery owner also needs to ensure her employees and their customers are comfortable, so she makes sure the bakery is heated in the winter and cooled in the summer. In addition, the bakery needs to turn on the lights to display the baked goods properly, the Open sign in the window needs to be plugged in, and the computer needs to be running in order to use the point-of-sale system. In the meantime, remember that the bakers need gas and electricity in order to use the ovens to produce baked goods. For example, Jessica owns a small bakery that employs 11 full- and part-time employees, including four bakers and seven sales and counter people.Įxcluding the bakers, who are considered part of the manufacturing process, all of the other employees' payroll expenses, including wages, payroll taxes, and benefits, are considered operating expenses and are part of the cost of doing business.

Operating expenses reflect the cost of keeping your business running.

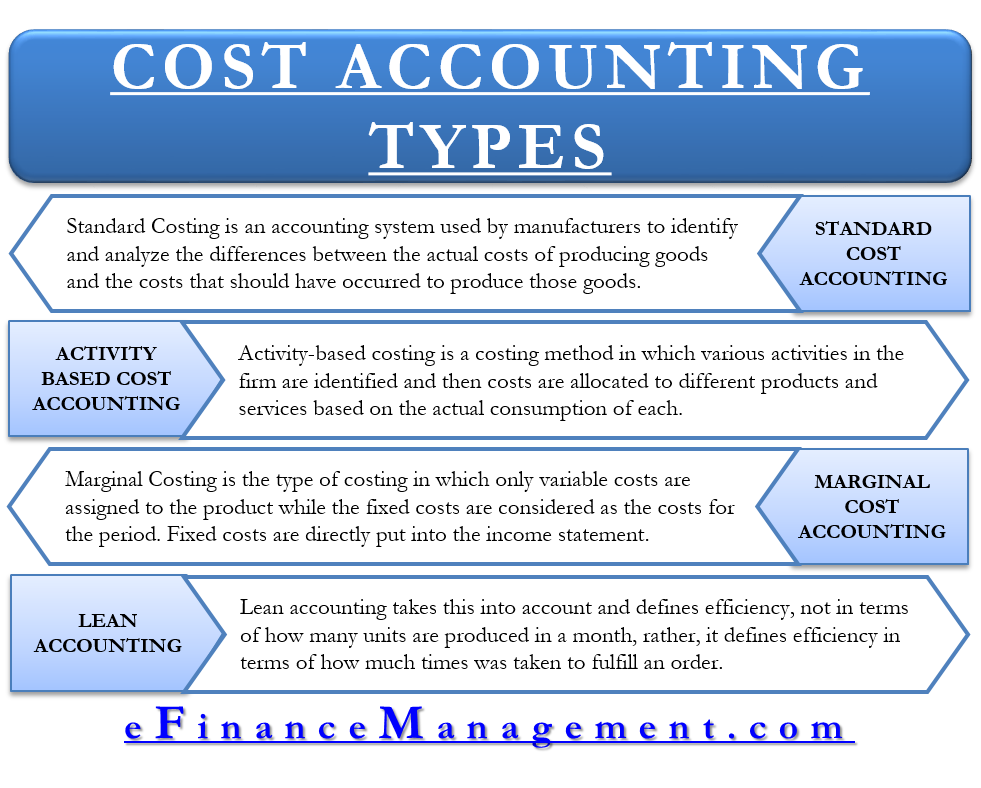

Operating expenses are not directly related to the production of products or services, but instead reflect what it truly costs to open your doors each day. Many, if not all, of these expense categories have a separate expense account in the general ledger. Typical operating expenses include rent, payroll, utilities, printing, postage, and property taxes. Operating expenses are the expenses your business incurs on a daily basis. These expenses incurred no matter what stage your business is in. Operating expenses are expenses incurred by your business that are not part of the production of products or services.

0 kommentar(er)

0 kommentar(er)